What Is An Open End Credit Card

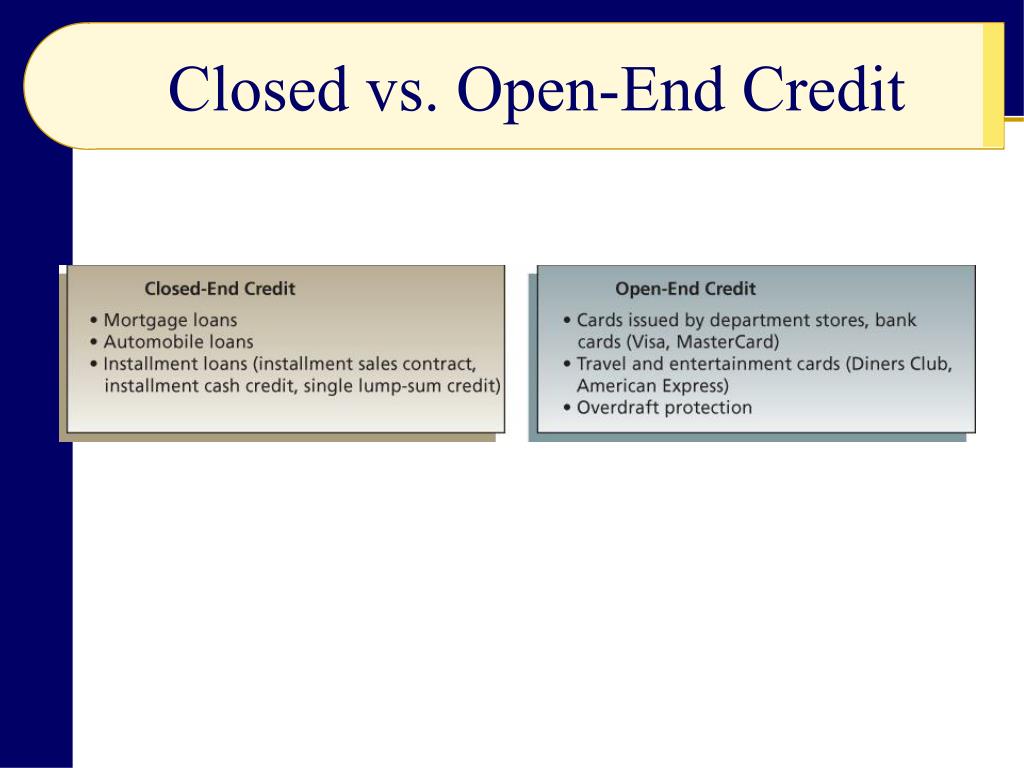

And the account is closed permanently after it’s paid off. Examples include credit cards, home equity loans, personal lines of credit and overdraft protection on checking accounts.

In other cases, the billing cycle may begin on the 15th of one month and go on till the 15 th of next month.

What is an open end credit card. With revolving credit, the amount of available credit , the balance, and the minimum payment can go up and down depending on the purchases and payments made to the account. The late payment won’t affect your credit score until it’s 30 days late and you might be able to get an extension if you call the card company. Missing a credit card payment isn’t the end of the world but you do need to be on top of it.

In the case of a credit card account under an open end consumer credit plan under which a late fee or charge may be imposed due to the failure of the obligor to make payment on or before the due date for such payment, the periodic statement required under subsection (b) with respect to the account shall include, in a conspicuous location on the billing statement, the. A type of revolving account that permits an individual to pay, on a monthly basis, only a portion of the total amount due. For any credit card, the time frame between two bills raised is known as the billing cycle.

Now your credit card issuer is out of the picture. Revolving credit is a type of credit that can be used repeatedly up to a certain limit as long as the account is open and payments are made on time. If you don’t call the card issuer then a late fee of between $27 to $35 will be added to your bill.

With revolving credit, you can use the line of credit repeatedly—up to a certain credit limit—for as long as the account is open. Any interest rate increases that have occurred − or will occur − since january 1, 2009, will be subject to a mandatory “look back” review at least once every six months, beginning 15 months after enactment. Such references cannot be given in exchange for a waived or a reduced facility fee, or for any other benefit or advantage.

See interpretation of this section in supplement i Credit card statements rarely have an ending date that coincides with the end of the month. How credit card interest works the credit card issuer gives you a certain amount of time to pay back the entire amount that you’ve borrowed before you're charged interest.

The information magnetically encoded in the magnetic stripe includes secret data that helps validate the. Credit card information that is transferred directly as a result of swiping or sliding the credit card through a card reader. In some cases, the billing cycle will begin on the 1st of each month and will go on till the 30 th or 31 st of that month.

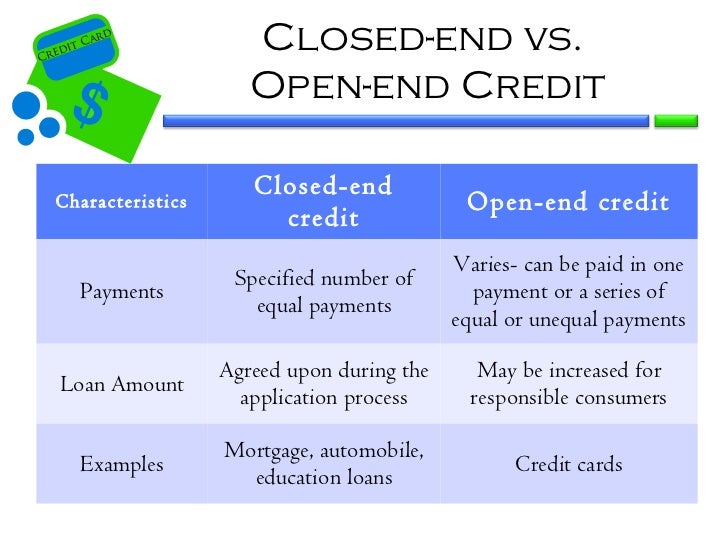

Location owners' names, logos or house colours cannot be used.] For example, if you want to buy a car, the loan can only be used for that car. This type of consumer credit is frequently used in conjunction with bank and department store credit cards.

Credit card billing cycles may also vary in length. But with nonrevolving credit, you can borrow the amount only once. Credit cards and open end credit are very similar because the borrower controls how much to borrow.

Moreover, unused amounts of the open end credit will not be charged any interest. Where a location is given, the name must appear in the same style as the rest of the credit sequence. Nonrevolving credit is also known as installment credit.

Home depot credit card review summary. Your debt belongs to a collector, and you’ll start getting flooded with phone calls asking.

0 Response to "What Is An Open End Credit Card"

Post a Comment